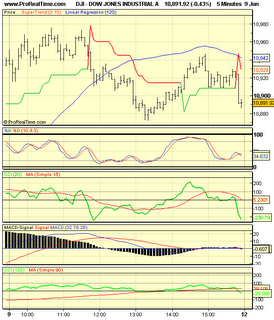

MACD histogram (momentum) signals also went up suddenly, normally it signals a change in direction. This time, it is an UP move.

Thus it would call for going LONG in stocks. $INDU also gave LONG signal.

The stock with BUY signal was KLAC. As it was a trending day buy, VWAP BUY should be used.

The stock with BUY signal was KLAC. As it was a trending day buy, VWAP BUY should be used.VWAP Buy features

- Green bars + Green ST + below VWAP in 5min chart

- Above SuperTrend in 30min chart

5-min chart

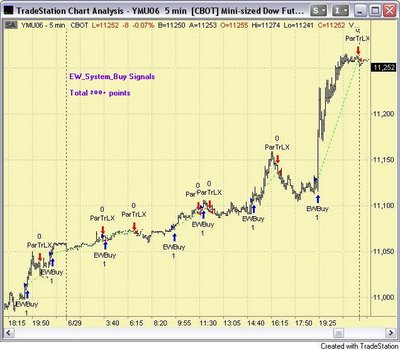

Buy and Sell signals are clearly marked with arrows.

30min chart

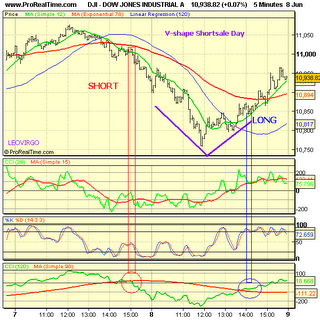

Note that SuperTrend was switched at 3:00pm. It allowed for LONG entries in 5min chart.

SuperTrend switch in 30 min charts are very important signals.