It's below last 3 days' means. Target is Day ATR from yMean.

It's below last 3 days' means. Target is Day ATR from yMean.Wednesday, December 30, 2009

Monday, December 28, 2009

Sunday, December 20, 2009

Thursday, December 17, 2009

VWAP ENGINE is simple enough to see whether to buy or sell. The area where professionalism is called for is in Money Management.

Monday, December 14, 2009

Friday, December 11, 2009

Cable MeanBoxTrendLine

Thursday, December 03, 2009

Tuesday, December 01, 2009

Thursday, November 26, 2009

Breakout buy and sell

Wednesday, November 25, 2009

Tuesday, November 24, 2009

EURGBP BUY into blue zone

Buy when it comes into blue zone with stop just below yMean.

60ATR is 10pips, so targetting 22pips and then 60pips (80% of Day ATR 76pips).

Monday, November 23, 2009

Tuesday, November 10, 2009

UJ Sell

Been selling USDJPY for last few days and today is another attempt.

Expected move is 1.00 (cycle high to low) if it breaks lows of prior days.

Tuesday, November 03, 2009

Friday, October 30, 2009

Monday, October 26, 2009

GBPJPY

It is a weak day but buying from just below mean is going well, so far. Blue box represent Day ATR. Let's see if it can go up further.

Sunday, October 25, 2009

EuroSterling turning points

.PNG) This is an example of vwap engine application on forex pair EURGBP. I think it should be called FX Engine.

This is an example of vwap engine application on forex pair EURGBP. I think it should be called FX Engine.Thursday, October 22, 2009

Wednesday, October 21, 2009

Tuesday, October 20, 2009

Capturing 1 Day ATR move

I am now concentrating on capturing major portion of Daily ATR (average true range).

I am now concentrating on capturing major portion of Daily ATR (average true range).The logic is that - they must move Daily ATR, so why not ride it out.

It would make a trader 'A' class to capture 70-80% of Daily ATR with consistency.

On the charts shown, daily ATR is marked with blue boxes whereas entries are marked with yellow arrows.

USDJPY was left with nothing much as it did come back to entry point; however, GBPJPY hit the target level.

Monday, October 12, 2009

EG reached target

This is one of the vwap engine set ups.

Buy from MDM with final target at Daily ATR distance away from entry level.

Stoploss is 1.5ATR of hourly bars.

On this chart:

Red line = final support line, below that is potential trend change

Blue lines = target lines

White line = original expected trend line

Green line = target line from white line

Buy from MDM with final target at Daily ATR distance away from entry level.

Stoploss is 1.5ATR of hourly bars.

On this chart:

Red line = final support line, below that is potential trend change

Blue lines = target lines

White line = original expected trend line

Green line = target line from white line

Wednesday, September 30, 2009

GJ again

Plan for today is to sell 50% only due to bounce zone conditions.

Sell when cycle crossing below 143.88

Target = 142, just above 141.97 LL value

Stoploss = just above upper TL (or) H1 cycle up

Tuesday, September 29, 2009

GJ short

This is GJ short earlier this morning.

This is GJ short earlier this morning.Banked 80pips 50% but the other half was stopped out at break even trailing stop.

Kep points

1. H4 at outer region of Daily ATR channel.

2. Strong mean set up

3. Support kicks in at yesterday's congestion area.

Thursday, September 17, 2009

Money Management 2

Define Risk

There are two kinds of risk level to determine before going ahead with money management framework- i) monetary risk and ii) technical risk.

Monetary risk

It is simply the dollar amount willing to risk for each trade. Usually it is a percentage of the account size e.g, 1%, 2% or 3% etc.

Technical risk

It is a price level at which the position will be closed, usually in a loss. It can either be fixed ( e.g, support/resistance line) or dynamic ( e.g, trend following with moving average).

Monetary risk + technical risk = position sizing

So far, it is easy to calculate position size for a given set up. In the past, I used to end up here thinking that my trading plan was complete. I know my risk, TA stoploss is there and position sizing is perfect! But there is a much bigger thing to consider.

There are two kinds of risk level to determine before going ahead with money management framework- i) monetary risk and ii) technical risk.

Monetary risk

It is simply the dollar amount willing to risk for each trade. Usually it is a percentage of the account size e.g, 1%, 2% or 3% etc.

Technical risk

It is a price level at which the position will be closed, usually in a loss. It can either be fixed ( e.g, support/resistance line) or dynamic ( e.g, trend following with moving average).

Monetary risk + technical risk = position sizing

So far, it is easy to calculate position size for a given set up. In the past, I used to end up here thinking that my trading plan was complete. I know my risk, TA stoploss is there and position sizing is perfect! But there is a much bigger thing to consider.

Labels:

expectancy,

Money Management,

position size,

risk

Money Management

What is the most important thing in money management?

It is to produce positive expectancy.

How do we achieve that?

Easy, profits must be greater than losses for one of the followings

i) a set time interval .. daily, weekly or monthly etc, or

ii) a set number of trades.

That requires historic performance or projected performance. Win:loss money value ratio and winning trade % are required to calculate expectancy of a method.

When a new method or system is launched, there is no reliable performance data to be used as a benchmark. Backtesting can be done, but it is too idealistic as it lacks human factor in the equation. Therefore, the money management frameworks tends to be geared towards ideal situation and a trader may find it hard to copy that in real live trading.

The irony is that without no reliable performance data, money management framework can't be formulated. It's like a bit of chicken and egg situation. So how do we do that?

It is to produce positive expectancy.

How do we achieve that?

Easy, profits must be greater than losses for one of the followings

i) a set time interval .. daily, weekly or monthly etc, or

ii) a set number of trades.

That requires historic performance or projected performance. Win:loss money value ratio and winning trade % are required to calculate expectancy of a method.

When a new method or system is launched, there is no reliable performance data to be used as a benchmark. Backtesting can be done, but it is too idealistic as it lacks human factor in the equation. Therefore, the money management frameworks tends to be geared towards ideal situation and a trader may find it hard to copy that in real live trading.

The irony is that without no reliable performance data, money management framework can't be formulated. It's like a bit of chicken and egg situation. So how do we do that?

Monday, August 31, 2009

Wednesday, August 26, 2009

Monday, August 24, 2009

The risk of a double-dip recession is rising

By Nouriel Roubini

Published: August 23 2009 18:55

T he global economy is starting to bottom out from the worst recession and financial crisis since the Great Depression. In the fourth quarter of 2008 and first quarter of 2009 the rate at which most advanced economies were contracting was similar to the gross domestic product free-fall in the early stage of the Depression. Then, late last year, policymakers who had been behind the curve finally started to use most of the weapons in their arsenal.

That effort worked and the free-fall of economic activity eased. There are three open questions now on the outlook. When will the global recession be over? What will be the shape of the economic recovery? Are there risks of a relapse?

On the first question it looks like the global economy will bottom out in the second half of 2009. In many advanced economies (the US, UK, Spain, Italy and other eurozone members) and some emerging market economies (mostly in Europe) the recession will not be formally over before the end of the year, as green shoots are still mixed with weeds. In some other advanced economies (Australia, Germany, France and Japan) and most emerging markets (China, India, Brazil and other parts of Asia and Latin America) the recovery has already started.

On the second issue the debate is between those – most of the economic consensus – who expect a V-shaped recovery with a rapid return to growth and those – like myself – who believe it will be U-shaped, anaemic and below trend for at least a couple of years, after a couple of quarters of rapid growth driven by the restocking of inventories and a recovery of production from near Depression levels.

There are several arguments for a weak U-shaped recovery . Employment is still falling sharply in the US and elsewhere – in advanced economies, unemployment will be above 10 per cent by 2010. This is bad news for demand and bank losses, but also for workers’ skills, a key factor behind long-term labour productivity growth.

Second, this is a crisis of solvency, not just liquidity, but true deleveraging has not begun yet because the losses of financial institutions have been socialised and put on government balance sheets. This limits the ability of banks to lend, households to spend and companies to invest.

Third, in countries running current account deficits, consumers need to cut spending and save much more, yet debt-burdened consumers face a wealth shock from falling home prices and stock markets and shrinking incomes and employment.

Fourth, the financial system – despite the policy support – is still severely damaged. Most of the shadow banking system has disappeared, and traditional banks are saddled with trillions of dollars in expected losses on loans and securities while still being seriously undercapitalised.

Fifth, weak profitability – owing to high debts and default risks, low growth and persistent deflationary pressures on corporate margins – will constrain companies’ willingness to produce, hire workers and invest.

Sixth, the releveraging of the public sector through its build-up of large fiscal deficits risks crowding out a recovery in private sector spending. The effects of the policy stimulus, moreover, will fizzle out by early next year, requiring greater private demand to support continued growth.

Seventh, the reduction of global imbalances implies that the current account deficits of profligate economies, such as the US, will narrow the surpluses of countries that over-save (China and other emerging markets, Germany and Japan). But if domestic demand does not grow fast enough in surplus countries, this will lead to a weaker recovery in global growth.

There are also now two reasons why there is a rising risk of a double-dip W-shaped recession. For a start, there are risks associated with exit strategies from the massive monetary and fiscal easing: policymakers are damned if they do and damned if they don’t. If they take large fiscal deficits seriously and raise taxes, cut spending and mop up excess liquidity soon, they would undermine recovery and tip the economy back into stag-deflation (recession and deflation).

But if they maintain large budget deficits, bond market vigilantes will punish policymakers. Then, inflationary expectations will increase, long-term government bond yields would rise and borrowing rates will go up sharply, leading to stagflation.

Another reason to fear a double-dip recession is that oil, energy and food prices are now rising faster than economic fundamentals warrant, and could be driven higher by excessive liquidity chasing assets and by speculative demand. Last year, oil at $145 a barrel was a tipping point for the global economy, as it created negative terms of trade and a disposable income shock for oil importing economies. The global economy could not withstand another contractionary shock if similar speculation drives oil rapidly towards $100 a barrel.

In summary, the recovery is likely to be anaemic and below trend in advanced economies and there is a big risk of a double-dip recession.

The writer is professor of economics at the Stern School of Business, NYU

Copyright The Financial Times Limited 2009.

Published: August 23 2009 18:55

T he global economy is starting to bottom out from the worst recession and financial crisis since the Great Depression. In the fourth quarter of 2008 and first quarter of 2009 the rate at which most advanced economies were contracting was similar to the gross domestic product free-fall in the early stage of the Depression. Then, late last year, policymakers who had been behind the curve finally started to use most of the weapons in their arsenal.

That effort worked and the free-fall of economic activity eased. There are three open questions now on the outlook. When will the global recession be over? What will be the shape of the economic recovery? Are there risks of a relapse?

On the first question it looks like the global economy will bottom out in the second half of 2009. In many advanced economies (the US, UK, Spain, Italy and other eurozone members) and some emerging market economies (mostly in Europe) the recession will not be formally over before the end of the year, as green shoots are still mixed with weeds. In some other advanced economies (Australia, Germany, France and Japan) and most emerging markets (China, India, Brazil and other parts of Asia and Latin America) the recovery has already started.

On the second issue the debate is between those – most of the economic consensus – who expect a V-shaped recovery with a rapid return to growth and those – like myself – who believe it will be U-shaped, anaemic and below trend for at least a couple of years, after a couple of quarters of rapid growth driven by the restocking of inventories and a recovery of production from near Depression levels.

There are several arguments for a weak U-shaped recovery . Employment is still falling sharply in the US and elsewhere – in advanced economies, unemployment will be above 10 per cent by 2010. This is bad news for demand and bank losses, but also for workers’ skills, a key factor behind long-term labour productivity growth.

Second, this is a crisis of solvency, not just liquidity, but true deleveraging has not begun yet because the losses of financial institutions have been socialised and put on government balance sheets. This limits the ability of banks to lend, households to spend and companies to invest.

Third, in countries running current account deficits, consumers need to cut spending and save much more, yet debt-burdened consumers face a wealth shock from falling home prices and stock markets and shrinking incomes and employment.

Fourth, the financial system – despite the policy support – is still severely damaged. Most of the shadow banking system has disappeared, and traditional banks are saddled with trillions of dollars in expected losses on loans and securities while still being seriously undercapitalised.

Fifth, weak profitability – owing to high debts and default risks, low growth and persistent deflationary pressures on corporate margins – will constrain companies’ willingness to produce, hire workers and invest.

Sixth, the releveraging of the public sector through its build-up of large fiscal deficits risks crowding out a recovery in private sector spending. The effects of the policy stimulus, moreover, will fizzle out by early next year, requiring greater private demand to support continued growth.

Seventh, the reduction of global imbalances implies that the current account deficits of profligate economies, such as the US, will narrow the surpluses of countries that over-save (China and other emerging markets, Germany and Japan). But if domestic demand does not grow fast enough in surplus countries, this will lead to a weaker recovery in global growth.

There are also now two reasons why there is a rising risk of a double-dip W-shaped recession. For a start, there are risks associated with exit strategies from the massive monetary and fiscal easing: policymakers are damned if they do and damned if they don’t. If they take large fiscal deficits seriously and raise taxes, cut spending and mop up excess liquidity soon, they would undermine recovery and tip the economy back into stag-deflation (recession and deflation).

But if they maintain large budget deficits, bond market vigilantes will punish policymakers. Then, inflationary expectations will increase, long-term government bond yields would rise and borrowing rates will go up sharply, leading to stagflation.

Another reason to fear a double-dip recession is that oil, energy and food prices are now rising faster than economic fundamentals warrant, and could be driven higher by excessive liquidity chasing assets and by speculative demand. Last year, oil at $145 a barrel was a tipping point for the global economy, as it created negative terms of trade and a disposable income shock for oil importing economies. The global economy could not withstand another contractionary shock if similar speculation drives oil rapidly towards $100 a barrel.

In summary, the recovery is likely to be anaemic and below trend in advanced economies and there is a big risk of a double-dip recession.

The writer is professor of economics at the Stern School of Business, NYU

Copyright The Financial Times Limited 2009.

Friday, August 07, 2009

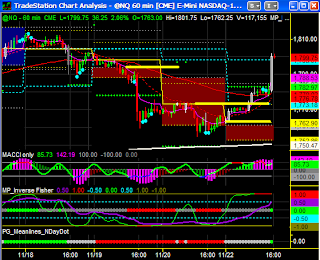

CycX LONG on all EQX Futures

White cross bars (CycX LONG) on all Equity Index Futures.

Market Breadth was also heavily bullish, hence the break out to the new highs.

Market Breadth was also heavily bullish, hence the break out to the new highs.

Thursday, August 06, 2009

Tuesday, July 07, 2009

No O/B no problem, just sell with price action and ticks

This LTF chart is part of bigger 60minute Reversal set up. ETF was already OB-. So look to sell with LTF (T400) for NQ.

Usually, it should be taken at OB and/or meanlines. But this time, there is no OB on T400. Cycles became weaker and weaker. H1, H2 and third time testing H1 level.

At that time, T100 was OB- and already weak.

Therefore, take 'reversal short' at T100 OB- and broke with down bars below vwap.

Yes, it went down as low as 1421 ( from 1438, so +17pts, 68 ticks move).

Friday, June 26, 2009

Inflation – the real threat to sustained recovery

By Alan Greenspan

http://www.ft.com/cms/s/0/e1fbc4e6-6194-11de-9e03-00144feabdc0.html

Published: June 25 2009 15:49 Last updated: June 25 2009 15:49

The rise in global stock prices from early March to mid-June is arguably the primary cause of the surprising positive turn in the economic environment. The $12,000bn of newly created corporate equity value has added significantly to the capital buffer that supports the debt issued by financial and non-financial companies. Corporate debt, as a consequence, has been upgraded and yields have fallen. Previously capital-strapped companies have been able to raise considerable debt and equity in recent months. Market fears of bank insolvency, particularly, have been assuaged.

Is this the beginning of a prolonged economic recovery or a false dawn? There are credible arguments on both sides of the issue. I conjectured over a year ago on these pages that the crisis will end when home prices in the US stabilise. That still appears right. Such prices largely determine the amount of equity in homes – the ultimate collateral for the $11,000bn of US home mortgage debt, a significant share of which is held in the form of asset-backed securities outside the US. Prices are currently being suppressed by a large overhang of vacant houses for sale. Owing to the recent sharp drop in house completions, this overhang is being liquidated in earnest, suggesting prices could start to stabilise in the next several months – although they could drift lower into 2010. In addition, huge unrecognised losses of US banks still need to be funded. Either a stabilisation of home prices or a further rise in newly created equity value available to US financial intermediaries would address this impediment to recovery.

Global stock markets have rallied so far and so fast this year that it is difficult to imagine they can proceed further at anywhere near their recent pace. But what if, after a correction, they proceeded inexorably higher? That would bolster global balance sheets with large amounts of new equity value and supply banks with the new capital that would allow them to step up lending. Higher share prices would also lead to increased household wealth and spending, and the rising market value of existing corporate assets (proxied by stock prices) relative to their replacement cost would spur new capital investment. Leverage would be materially reduced. A prolonged recovery in global equity prices would thus assist in the lifting of the deflationary forces that still hover over the global economy.

I recognise that I accord a much larger economic role to equity prices than is the conventional wisdom. From my perspective, they are not merely an important leading indicator of global business activity, but a major contributor to that activity, operating primarily through balance sheets. My hypothesis will be tested in the year ahead. If shares fall back to their early spring lows or worse, I would expect the “green shoots” spotted in recent weeks to wither.

Stock prices, to be sure, are affected by the usual economic gyrations. But, as I noted in March, a significant driver of stock prices is the innate human propensity to swing between euphoria and fear, which, while heavily influenced by economic events, has a life of its own. In my experience, such episodes are often not mere forecasts of future business activity, but major causes of it.

For the benevolent scenario above to play out, the short-term dangers of deflation and longer-term dangers of inflation have to be confronted and removed. Excess capacity is temporarily suppressing global prices. But I see inflation as the greater future challenge. If political pressures prevent central banks from reining in their inflated balance sheets in a timely manner, statistical analysis suggests the emergence of inflation by 2012; earlier if markets anticipate a prolonged period of elevated money supply. Annual price inflation in the US is significantly correlated (with a 3½-year lag) with annual changes in money supply per unit of capacity.

Inflation is a special concern over the next decade given the pending avalanche of government debt about to be unloaded on world financial markets. The need to finance very large fiscal deficits during the coming years could lead to political pressure on central banks to print money to buy much of the newly issued debt.

The Federal Reserve, when it perceives that the unemployment rate is poised to decline, will presumably start to allow its short-term assets to run off, and either sell its newly acquired bonds, notes and asset-backed securities or, if that proves too disruptive to markets, issue (with congressional approval) Fed debt to sterilise, or counter, what is left of its huge expansion of the monetary base. Thus, interest rates would rise well before the restoration of full employment, a policy that, in the past, has not been viewed favourably by Congress. Moreover, unless US government spending commitments are stretched out or cut back, real interest rates will be likely to rise even more, owing to the need to finance the widening deficit.

Government spending commitments over the next decade are staggering. On top of that, the range of error is particularly large owing to the uncertainties in forecasting Medicare costs. Historically, the US, to limit the likelihood of destructive inflation, relied on a large buffer between the level of federal debt and rough measures of total borrowing capacity. Current debt issuance projections, if realised, will surely place America precariously close to that notional borrowing ceiling. Fears of an eventual significant pick-up in inflation may soon begin to be factored into longer-term US government bond yields, or interest rates. Should real long-term interest rates become chronically elevated, share prices, if history is any guide, will remain suppressed.

The US is faced with the choice of either paring back its budget deficits and monetary base as soon as the current risks of deflation dissipate, or setting the stage for a potential upsurge in inflation. Even absent the inflation threat, there is another potential danger inherent in current US fiscal policy: a major increase in the funding of the US economy through public sector debt. Such a course for fiscal policy is a recipe for the political allocation of capital and an undermining of the process of “creative destruction” – the private sector market competition that is essential to rising standards of living. This paradigm’s reputation has been badly tarnished by recent events. Improvements in financial regulation and supervision, especially in areas of capital adequacy, are necessary. However, for the best chance for worldwide economic growth we must continue to rely on private market forces to allocate capital and other resources. The alternative of political allocation of resources has been tried; and it failed.

The writer is former chairman of the US Federal Reserve

http://www.ft.com/cms/s/0/e1fbc4e6-6194-11de-9e03-00144feabdc0.html

Published: June 25 2009 15:49 Last updated: June 25 2009 15:49

The rise in global stock prices from early March to mid-June is arguably the primary cause of the surprising positive turn in the economic environment. The $12,000bn of newly created corporate equity value has added significantly to the capital buffer that supports the debt issued by financial and non-financial companies. Corporate debt, as a consequence, has been upgraded and yields have fallen. Previously capital-strapped companies have been able to raise considerable debt and equity in recent months. Market fears of bank insolvency, particularly, have been assuaged.

Is this the beginning of a prolonged economic recovery or a false dawn? There are credible arguments on both sides of the issue. I conjectured over a year ago on these pages that the crisis will end when home prices in the US stabilise. That still appears right. Such prices largely determine the amount of equity in homes – the ultimate collateral for the $11,000bn of US home mortgage debt, a significant share of which is held in the form of asset-backed securities outside the US. Prices are currently being suppressed by a large overhang of vacant houses for sale. Owing to the recent sharp drop in house completions, this overhang is being liquidated in earnest, suggesting prices could start to stabilise in the next several months – although they could drift lower into 2010. In addition, huge unrecognised losses of US banks still need to be funded. Either a stabilisation of home prices or a further rise in newly created equity value available to US financial intermediaries would address this impediment to recovery.

Global stock markets have rallied so far and so fast this year that it is difficult to imagine they can proceed further at anywhere near their recent pace. But what if, after a correction, they proceeded inexorably higher? That would bolster global balance sheets with large amounts of new equity value and supply banks with the new capital that would allow them to step up lending. Higher share prices would also lead to increased household wealth and spending, and the rising market value of existing corporate assets (proxied by stock prices) relative to their replacement cost would spur new capital investment. Leverage would be materially reduced. A prolonged recovery in global equity prices would thus assist in the lifting of the deflationary forces that still hover over the global economy.

I recognise that I accord a much larger economic role to equity prices than is the conventional wisdom. From my perspective, they are not merely an important leading indicator of global business activity, but a major contributor to that activity, operating primarily through balance sheets. My hypothesis will be tested in the year ahead. If shares fall back to their early spring lows or worse, I would expect the “green shoots” spotted in recent weeks to wither.

Stock prices, to be sure, are affected by the usual economic gyrations. But, as I noted in March, a significant driver of stock prices is the innate human propensity to swing between euphoria and fear, which, while heavily influenced by economic events, has a life of its own. In my experience, such episodes are often not mere forecasts of future business activity, but major causes of it.

For the benevolent scenario above to play out, the short-term dangers of deflation and longer-term dangers of inflation have to be confronted and removed. Excess capacity is temporarily suppressing global prices. But I see inflation as the greater future challenge. If political pressures prevent central banks from reining in their inflated balance sheets in a timely manner, statistical analysis suggests the emergence of inflation by 2012; earlier if markets anticipate a prolonged period of elevated money supply. Annual price inflation in the US is significantly correlated (with a 3½-year lag) with annual changes in money supply per unit of capacity.

Inflation is a special concern over the next decade given the pending avalanche of government debt about to be unloaded on world financial markets. The need to finance very large fiscal deficits during the coming years could lead to political pressure on central banks to print money to buy much of the newly issued debt.

The Federal Reserve, when it perceives that the unemployment rate is poised to decline, will presumably start to allow its short-term assets to run off, and either sell its newly acquired bonds, notes and asset-backed securities or, if that proves too disruptive to markets, issue (with congressional approval) Fed debt to sterilise, or counter, what is left of its huge expansion of the monetary base. Thus, interest rates would rise well before the restoration of full employment, a policy that, in the past, has not been viewed favourably by Congress. Moreover, unless US government spending commitments are stretched out or cut back, real interest rates will be likely to rise even more, owing to the need to finance the widening deficit.

Government spending commitments over the next decade are staggering. On top of that, the range of error is particularly large owing to the uncertainties in forecasting Medicare costs. Historically, the US, to limit the likelihood of destructive inflation, relied on a large buffer between the level of federal debt and rough measures of total borrowing capacity. Current debt issuance projections, if realised, will surely place America precariously close to that notional borrowing ceiling. Fears of an eventual significant pick-up in inflation may soon begin to be factored into longer-term US government bond yields, or interest rates. Should real long-term interest rates become chronically elevated, share prices, if history is any guide, will remain suppressed.

The US is faced with the choice of either paring back its budget deficits and monetary base as soon as the current risks of deflation dissipate, or setting the stage for a potential upsurge in inflation. Even absent the inflation threat, there is another potential danger inherent in current US fiscal policy: a major increase in the funding of the US economy through public sector debt. Such a course for fiscal policy is a recipe for the political allocation of capital and an undermining of the process of “creative destruction” – the private sector market competition that is essential to rising standards of living. This paradigm’s reputation has been badly tarnished by recent events. Improvements in financial regulation and supervision, especially in areas of capital adequacy, are necessary. However, for the best chance for worldwide economic growth we must continue to rely on private market forces to allocate capital and other resources. The alternative of political allocation of resources has been tried; and it failed.

The writer is former chairman of the US Federal Reserve

Wednesday, May 27, 2009

Reversal - First Trade for VE

INDU 60 is ready for reversal - IF neutral and MACCI cycle turning down from O/B, also has Grey Bars.

Just short when DIA ETF is OB and yellow reversal bar printed.

On cash charts, 10Minute MACCI also had $ADD MACCI reversal short bar.

Just short when DIA ETF is OB and yellow reversal bar printed.

On cash charts, 10Minute MACCI also had $ADD MACCI reversal short bar.

Thursday, May 21, 2009

Swing vs Day trade

Swing trading has larger time window to prepare and make decisions. It can also allow multi-intruments to be monitored.

Day trading requires close monitoring of opportunities and there is opportunity cost of missing larger swing trades.

ES in action 20-21 May

Day trading requires close monitoring of opportunities and there is opportunity cost of missing larger swing trades.

ES in action 20-21 May

Friday, March 20, 2009

yMean Rotation

This is a simple set-up with well-defined risk and rewards.

Basic conditions

1. Price re-test yMean

2. MACCI OB/OS (+signal dots)

3. IF cycle ready to turn

Entry

1. @vwap

2. ETF dual cycle or LTF cycle OB/OS

Risk (stoploss)

1. yMean

Target (rewards)

1. m2, m3 if any or significant SR lines

2. IFF low to high/ high to low one swing

Monday, March 16, 2009

Directional Cycle Swing

60Minute Set UP

60Minute Set UPHere NQ100 60MACCI cycle down when crossing yM ( grey bar ).

T2000 Set Up

Wait for T2000 to OB or down, here in this case it is OB and down.

RR Calculation

This is directional cycle swing trade at

Entry = 1162.50 (vwap)

Stoploss = high of grey bar (1174.75) = 12.25pts

Target1 = Low of yesterday 1151 = 11.25pts (RR= 11.25/12.25)

Target2 = M2 @ 1142.60 = 20pts ( RR= 20/12.25)

Target3 = M3 @ 1124 (RR= 38.50/12.25)

Trade management is to set at breakeven at 1151.

INDU Bullish = NO SELLSHORT

Thursday, March 05, 2009

The Path of Least Resistance

Today, all the indices were lazy chaps. I said that because they all wanted to pursue the path of least resistance. Most of them were below the pivot lines (various VWAPs) before the open except INDU which was boxed inside mean lines.

There was some potential to see cycle up in futures but INDU cash called the shots.

INDU cycles shifted to DOWN/DOWN and all of them were forced top down.

Market Internals were bearish since the open and that really set the tone.

Thursday, February 12, 2009

Monday, February 02, 2009

VWAP ENGINE : 2 days to auto trading

This is today's trades from VWAP engine. It is still being refined and will be automated in two days' time. It produced a total of 3 trades today- of which 2 were winners - second trade ( a loss ) was due to programming glitch which had been corrected.

Subscribe to:

Posts (Atom)