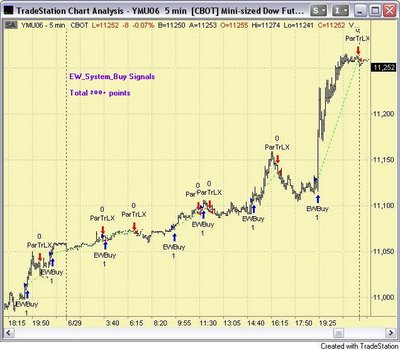

The chart above is Long entries since 28th evening break out time.

The chart above is Long entries since 28th evening break out time.Back testing results

The EW system is generating live signals. They are not automated as yet.

Results from back testing over the last three weeks are quite satisfactory. Here are the results from 8 June to 29 June:

Long Trades

- Total 16 trades;

- Winning Trades 11, Losing trades 5, BreakEven trades 0;

- Max win points in a trade : 128. Max loss trade (-22);

- Consecutive winning trades 5, consecutive losing trades 2;

- Average win/trade 52 pts, average loss/trade 21;

- Total win points 572, total loss points -104;

- Net winning points = 468.

Short Trades

- Total 45 trades;

- Winning Trades 19, Losing trades 16, BreakEven trades 10;

- ( BreakEven trades is triggered when the profits floor of 20 points was reached and then come back to EntryPrice )

- Max win points in a trade 123, max loss trade - 38;

- Consecutive winning trades 7, max losing trades 3;

- Average win/trade 33, average loss/trade 13;

- Total win points 629, Total loss points 211;

- Net Winning points 418;

TOTAL NET GAINS = 886.